The New Brunswick government collects money. And it spends money.

In the last decade, the New Brunswick government has spent a lot more than it has brought in. While we may all have different ideas about the best way to do it, every single member of our Coalition believes that overspending must stop.

Where does the money come from?

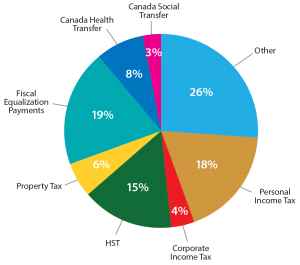

The New Brunswick government gets money from two sources– its own tax programs and the Federal government transfers. In 2017-2018, our provincial revenues are estimated at $9.2 Billion.

Federal government transfers represent 35% of that $9.2 Billion. The problem? We don’t have much control over that money. Someone else makes the decision about whether we should get it….. or not. They aren’tstable sources of revenue because as federal priorities change, so do our transfer payments.

Our “own source” revenues are the only ones we can influence. Those revenues come from personal and corporate income tax, natural resources royalties, fees, return on investments, lotteries, fines, and penalties.

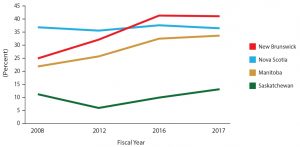

When we look at the how much tax New Brunswickers pay (the red line below) compared to residents of other provinces, it quickly becomes clear that if we want to remain competitive with the rest of the country, we can’t raise taxes. We’re already one of the highest taxed people in Canada.

Where does the money go?

Every voter should understand *how* are governments are spending our money. Just like a household, if you don’t know where your money is going, you can’t change your behavior to improve your financial health.

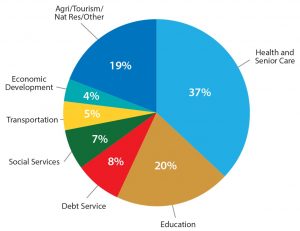

As you can see, health/senior care and education represent our largest expenditure areas– 57% of our total spending. In fact, we spend $2 out of every $3 on health, senior care, social development, and education.

We also have to pay interest on our debt. We spend more on debt interest payments than economic development, transportation, and social services. Most of those interest payments go out of province the US and other lenders and are subject to rate hikes, market volatility, and instability. Factors we don’t control.

By eliminating the deficit and balancing our finance, we mitigate the influence of outside factors can have on our public debt servicing costs.

When we lower the costs of servicing our debt, we can improve our bottom line without cutting public services. It also opens the door to new investments.